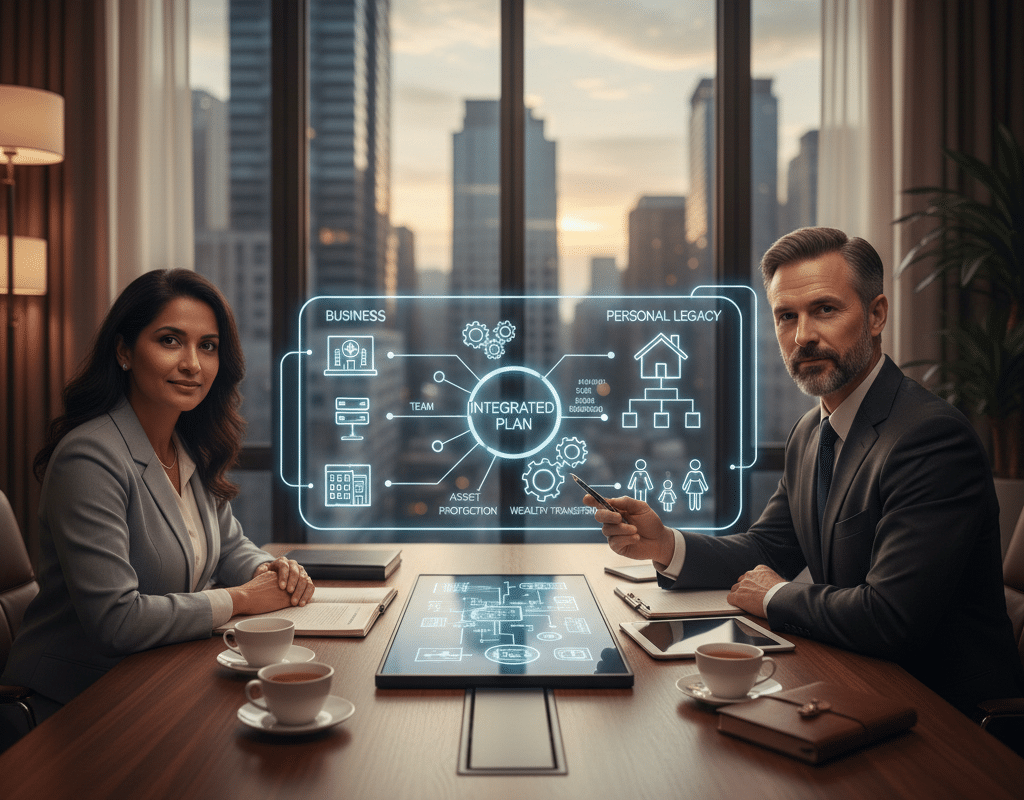

Why Integrated Estate & Business Planning Works

Integrated estate & business planning is often the missing link for high-achieving individuals who have mastered their craft but haven't yet bulletproofed their legacy. As a licensed professional or a successful business owner, you dedicate your life to building, protecting, and growing valuable assets—whether that’s a thriving medical practice, a boutique consultancy, or a [...]