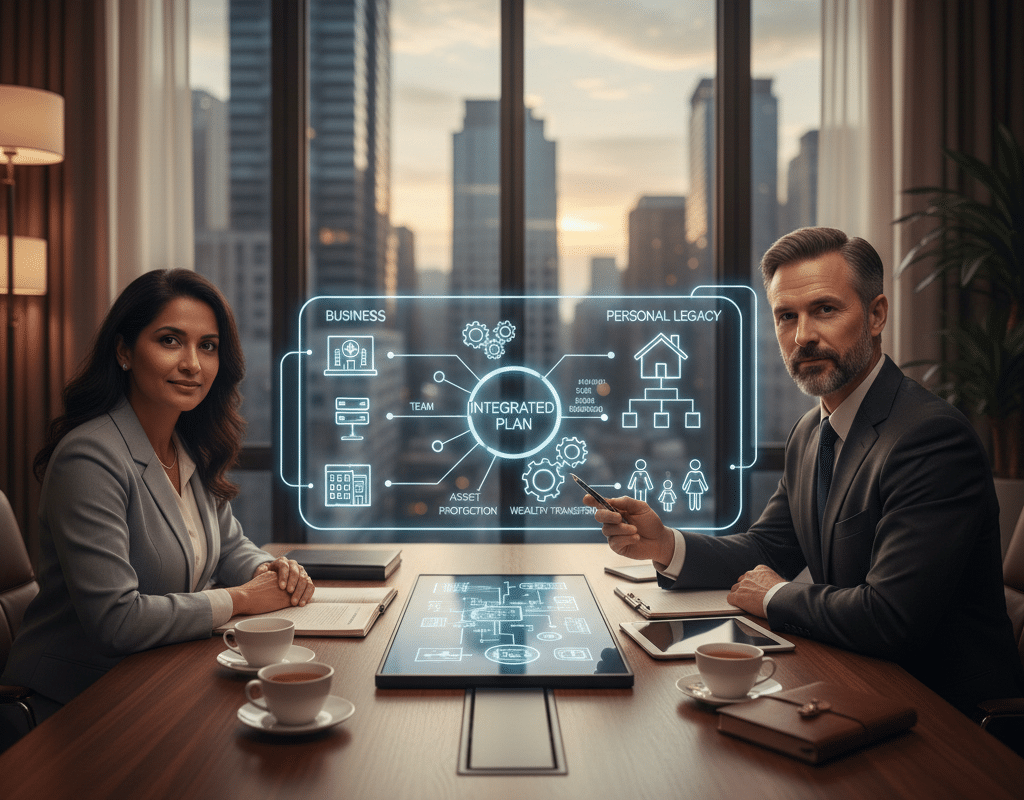

Integrated estate & business planning is often the missing link for high-achieving individuals who have mastered their craft but haven’t yet bulletproofed their legacy. As a licensed professional or a successful business owner, you dedicate your life to building, protecting, and growing valuable assets—whether that’s a thriving medical practice, a boutique consultancy, or a multi-unit enterprise. You excel at foresight within your field, but have you applied that same rigorous strategy to the interconnected futures of your personal wealth and your professional life?

Why Integrated Estate & Business Planning is Crucial for Business Owners

Many mistakenly view estate planning and business planning as separate silos. They believe one is for personal assets and the other solely for operational matters. However, for individuals like you, integrated estate & business planning is crucial to achieve balance in all aspects of your world. A disruption in one can have catastrophic consequences for the other.

Imagine the scenario: You’ve built a thriving medical practice, a successful real estate brokerage, or a booming consultancy. Your personal assets are substantial, and your business is a significant contributor to your wealth and identity. What happens to your practice, your partners, your employees, and ultimately, your family, if you suddenly become incapacitated or pass away?

The Pitfalls of Disconnected Planning

Without a holistic, integrated approach, you risk:

Business Chaos: Your practice or business might face immediate operational paralysis, leading to loss of clients, revenue, and goodwill. Partners might be left in limbo, unable to make critical decisions without clear guidance.

Estate Erosion: Delays and disputes surrounding your business can drain personal assets, as legal battles mount and the value of your enterprise diminishes. Your family could inherit a legal headache instead of a legacy.

Tax Inefficiencies: Unplanned transitions can trigger significant tax liabilities that could have been legally minimized with proper foresight.

Loss of Control: Without clear directives, courts or default state laws will decide the future of your business and how your assets are distributed, potentially against your wishes and certainly without understanding the nuances of your professional life.

Family Strain: The emotional toll of loss is compounded by financial uncertainty and complex legal battles, putting immense stress on your loved ones.

Integrating for Resilience: The Power of an Integrated Estate & Business Planning Unified Strategy

This is where integrated estate & business planning becomes not just beneficial, but essential. It’s about creating a comprehensive strategy that ensures the seamless continuity of your business and the secure transfer of your personal wealth, all while reflecting your values and protecting your loved ones.

Key Components of Integrated Estate & Business Planning for Professionals & Business Owners:

Succession Planning: Who takes the helm if you can’t? This isn’t just for retirement; it’s vital for unexpected events. It ensures your business continues to operate smoothly, protecting its value and providing for your family.

Buy-Sell Agreements: For partnerships or multi-owner businesses, these agreements dictate what happens if an owner leaves, becomes disabled, or passes away. They protect the remaining owners and ensure fair compensation for the departing owner’s estate.

Advanced Directives for Business: Beyond a personal Power of Attorney, consider designating someone with specific authority to manage your business affairs if you’re incapacitated.

Asset Protection Strategies: Structuring your business and personal assets to shield them from potential liabilities and creditors, securing what you’ve built.

Tax-Efficient Wealth Transfer: Strategies to minimize estate taxes and other levies, ensuring more of your hard-earned wealth passes to your chosen beneficiaries.

Personal Estate Documents (Wills, Trusts): Ensuring these documents clearly address the disposition of your business interests and integrate with your overall business succession plan.

Your Legacy Deserves Professional Protection

You’ve invested years, expertise, and immense effort into building your professional practice or business. Don’t leave its future, or the future of your family, to chance. Just as you advise your clients to plan for their futures, it’s crucial to apply that same wisdom to your own.

An integrated estate & business plan isn’t about preparing for the worst; it’s about proactively protecting everything you’ve worked so hard to achieve, ensuring your legacy endures, and providing peace of mind for yourself and your loved ones.

Ready to secure your future, both personally and professionally? Let’s connect and build an integrated estate & business planning strategy that works for you.

Like us on Facebook to keep up with new blog posts and news!

This article is intended to serve as a general summary of the issues outlined therein. While this article may include general guidance, it is not intended as, nor is a substitute for, qualified legal advice. Your review or receipt of this article by Lexern Law Offices, Ltd. (the “LLG”) or any of its attorneys does not create an attorney-client relationship between you and the LLG. The opinions expressed in this article are those of the authors of the article and do not reflect the opinion of the LLG. Please note that this article may have been generated using AI technology.