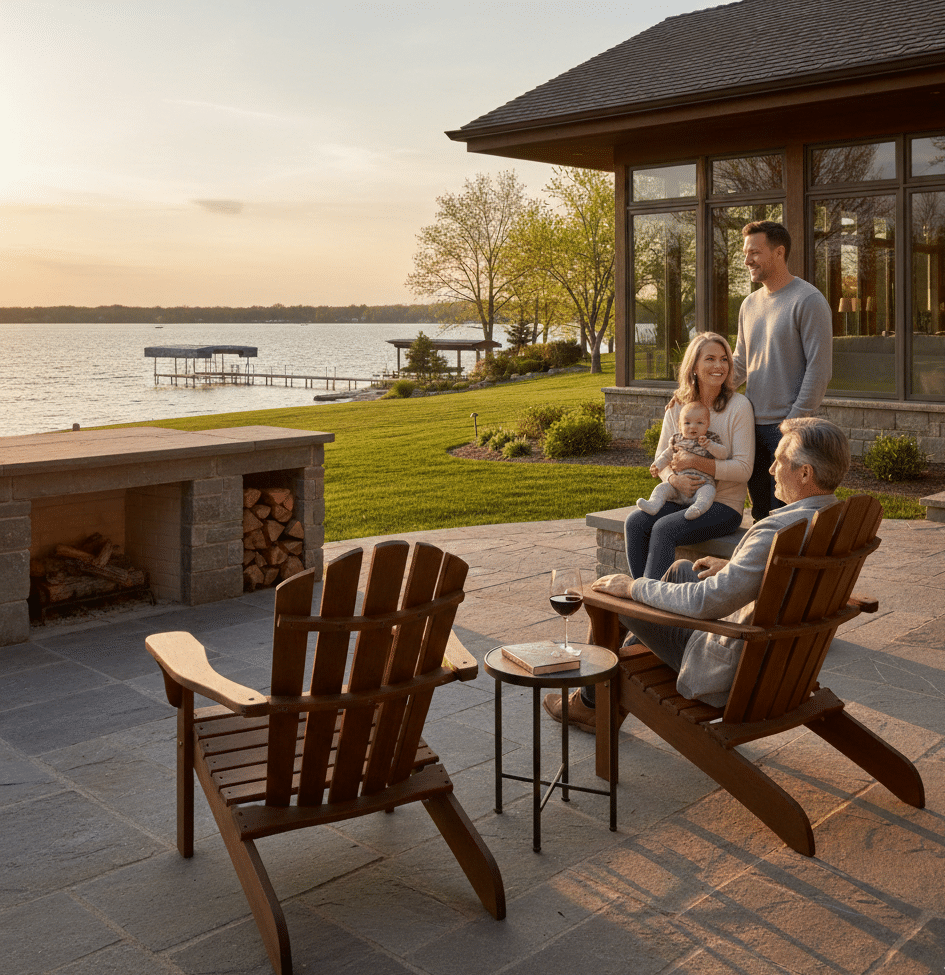

For many families in Illinois and Wisconsin, a vacation home is more than just real estate; it is a repository of memories, a sanctuary for multi-generational gatherings, and a significant component of a family’s legacy. However, without a strategic approach to estate planning for vacation homes, these cherished properties can become a source of legal complexity and family disharmony.

At Lexern Law Group, we help families navigate the unique challenges of passing down secondary residences, ensuring that your “happy place” remains a blessing for the next generation.

Why Estate Planning for Vacation Homes Requires Attention

Unlike a primary residence, a vacation home often involves “ancillary probate” if it is located in a different state (e.g., living in Illinois but owning a cabin in Wisconsin). Furthermore, the 2026 tax landscape introduces new considerations for high-net-worth families regarding property valuation and transfer taxes.

1. Avoiding the “Co-Ownership Trap”

Simply leaving a property to your children as “Joint Tenants” or “Tenants in Common” can be a recipe for disaster. If one heir wants to sell and the others don’t, it can lead to a forced partition sale. For estate planning for vacation homes, we recommend structured solutions like a Family LLC or a Qualified Personal Residence Trust (QPRT) to establish clear rules for usage, expenses, and buyout options. These may not apply for all situations, so always consult with an estate planning attorney both in your area and near your vacation properties.

2. Funding the Future: The Maintenance Endowment

A common mistake in estate planning for vacation homes is failing to provide the liquidity needed to maintain the property. We often advise clients to pair the transfer of the home with a dedicated “maintenance fund” held within a trust. This ensures that the burden of property taxes, insurance, and repairs doesn’t fall disproportionately on one heir or lead to the property’s eventual neglect.

3. Protecting Against Multi-State Probate

If you own property in both Illinois and Wisconsin, your estate could face probate in both states—doubling the time, cost, and public exposure of your private affairs. By titling your vacation home in a Revocable Living Trust, you can bypass probate entirely, allowing for a seamless transition of ownership.

4. Establishing a “Use Agreement”

Legacy is as much about family harmony as it is about assets. A well-drafted plan includes a governing document that outlines:

A fair schedule for peak-season usage.

Rules regarding guests and short-term rentals.

A mechanism for conflict resolution.

Preserve Your Family’s Sanctuary

The goal of estate planning for vacation homes is to ensure that the transition of ownership is as peaceful as a sunset on the water. Whether you are looking to mitigate taxes or prevent family disputes, the time to plan is now.

Protect your Illinois or Wisconsin retreat today. Our team is ready to help you craft a plan that secures your property and your family’s peace of mind.

Like us on Facebook to keep up with new blog posts and news!

This article is intended to serve as a general summary of the issues outlined therein. While this article may include general guidance, it is not intended as, nor is a substitute for, qualified legal advice. Your review or receipt of this article by Lexern Law Offices, Ltd. (the “LLG”) or any of its attorneys does not create an attorney-client relationship between you and the LLG. The opinions expressed in this article are those of the authors of the article and do not reflect the opinion of the LLG. Please note that this article may have been generated using AI technology.