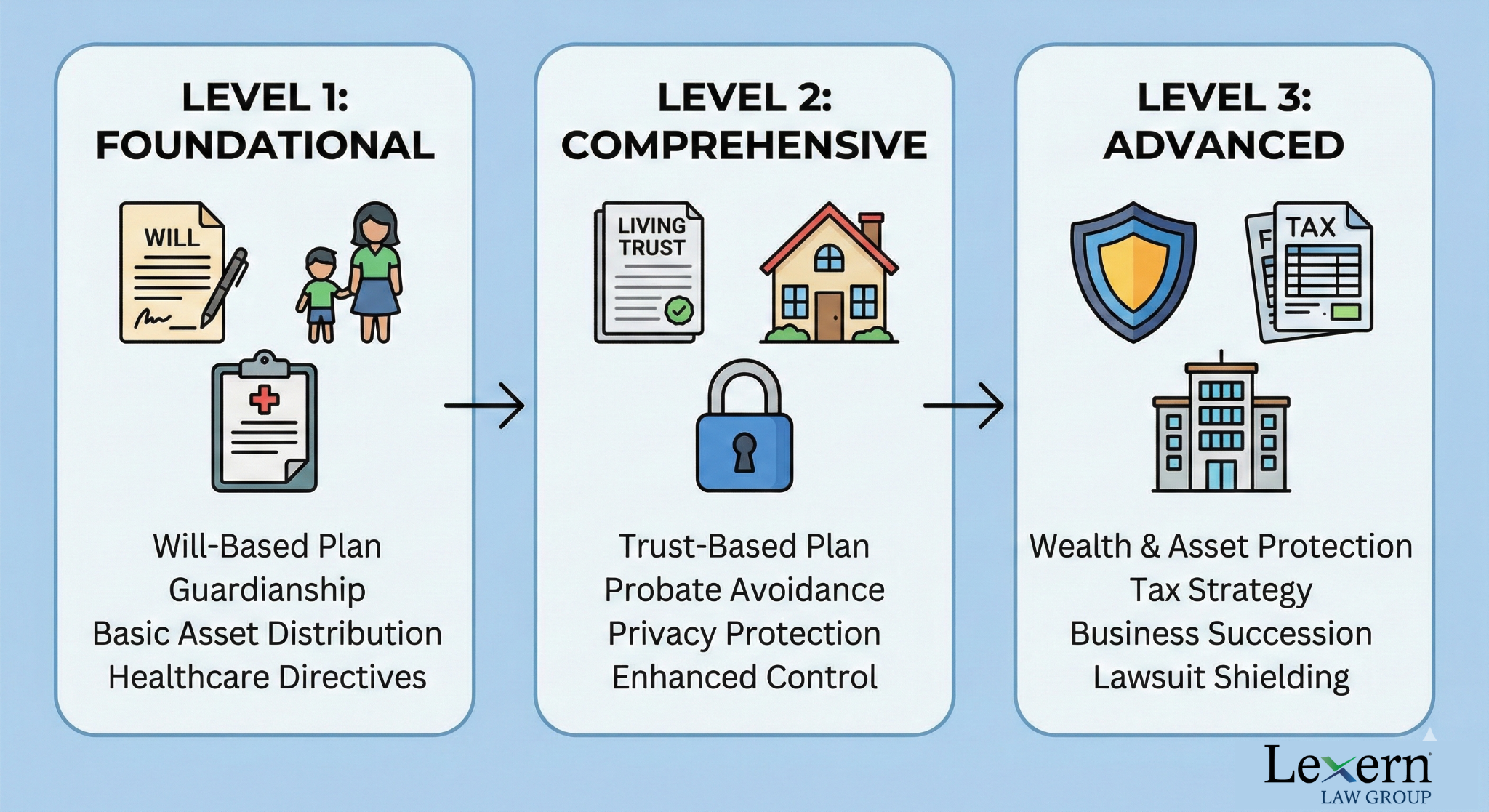

The 3 Levels of Estate Planning for Illinois & Wisconsin Families

Personalized Wealth Preservation Designed for Your Life

At Lexern Law Group, we believe estate planning is not a one-size-fits-all product…

We have developed a tiered process—the 3 Levels of Planning—to ensure your legal strategy aligns perfectly with your family’s needs, your budget, and your long-term goals. Every plan begins with our signature Family Wealth Planning Meeting, where we educate you on your options so you can make an empowered decision for the people you love.

Level 1: Foundational Will-Based Planning

Ideal for: Young families, individuals starting their careers, and those primarily concerned with guardianship.

Our Level 1 plan creates the “legal floor” for your family. This foundational approach ensures that if something happens to you, the state doesn’t decide who raises your children or how your personal assets are distributed.

Guardianship Designations: Naming the right people to care for your minor children.

Last Will & Testament: Directing your personal property and naming an executor.

Healthcare & Financial Power of Attorney: Appointing trusted advocates to speak for you if you become incapacitated.

Level 2: Comprehensive Trust-Based Planning

Ideal for: Homeowners, established families, and those seeking to avoid the “hassle and cost” of probate.

Level 2 is our most popular choice. It builds on the foundation of Level 1 but moves your assets into a Revocable Living Trust. This ensures your family avoids the public, expensive, and time-consuming probate court process in Illinois or Wisconsin.

Probate Avoidance: Assets pass directly to your heirs without court intervention.

Privacy Protection: Your family’s financial business stays out of the public record.

Enhanced Control: Define exactly how and when beneficiaries receive their inheritance (e.g., for education or at certain ages).

Level 3: Advanced Wealth & Asset Protection

Ideal for: Business owners, licensed professionals (Doctors, Dentists, Attorneys), and high-net-worth families.

Our Level 3 planning is a robust “legal firewall” designed to protect your wealth from the outside world. This level integrates your Business Succession Plan with your personal estate, focusing on tax efficiency and lawsuit shielding.

Asset Protection: Shielding your hard-earned wealth from potential malpractice claims, creditors, or future lawsuits.

Estate Tax Minimization: Utilizing advanced trust strategies to reduce federal and state estate tax liability.

Legacy Planning: Strategies for transferring values and vision, not just bank accounts, to the next generation.

Our Client-Centered Process: Education Before Documents

Unlike online document services that provide a false sense of security, our approach is proactive and educational.

Education: We explain the legal landscape of Illinois and Wisconsin based on your specific assets.

Choice: You choose the level of planning and the fee that aligns with your objectives.

Proactive Maintenance: Through our annual membership programs, we ensure your plan stays current as laws change and your family grows.

Serving Lake County, IL and Southeastern WI

From our offices in Libertyville, IL and Glendale, WI, we proudly serve families and business owners across the region, including Lake Forest, Vernon Hills, Milwaukee, and Mequon.